Selecting A Financial Coach

March 12, 2015

Which Direction Are You Looking?

May 16, 2015

I was recently in Timmins, Ontario to deliver a program called “Your Richly Imagined Future” that focuses on the multiple topics of personal finance, motivation, goal setting and creating a healthy relationship with money.

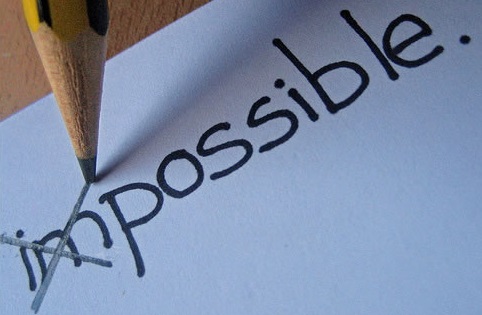

One of the attendees (approximately 30 years old by my guess…) said to me: “Robert, this “Richly Imagined Future Stuff” is all well and good for you, and maybe some of the others here tonight – but this can never happen for me”. I was a bit puzzled, so I decided to resort to the best question ever asked by a four year old – “Why?”

Their reply was a rambling 90 seconds about lack of opportunity, education, family history and insufficient income – ended with the comment – “that’s why!” As a speaker/educator/inspirer (ok, I aspire to the last one…) in the areas of personal finance and motivation – the concept of “this can never happen for me” was hard to fathom.

I asked if they remembered a slide from midway through the presentation that read:

“The quality of your life is determined by the quality of the decisions you make, which are determined by the quality of the questions you ask, which is determined by the quality of your education” - Brad Sugars

They acknowledged they did – but added – “But I didn’t go to university or college”, to which I replied “Perfect! That’s means you’ll have fewer things to unlearn…”. Books, classes, CDs, DVDs, webinars, seminars – all contribute to our education. We spent the next 10 minutes discussing the fact that there are plenty of people who are financially successful who have never set foot in college or university, and that “education” refers to what we learn – not where we learn it. Their smile indicated I had struck a nerve – probably because somebody in their past mistakenly told them that school was the only place to get an education.

The next 20 minutes was a delightful conversation that focused on three questions that I believe are key to making ourselves successful with our personal finances.

1) What do you believe?

Henry Ford was once quoted as saying – “If you believe you can, or if you believe you can’t – you’re right”. Our beliefs about money are much the same. If you believe you can be successful with money – odds are good you will. If you believe the odds are stacked against you – it’s likely you will not become successful. Please don’t read “But Robert said it would be easy…” into this discussion. As human beings, it’s not that we believe everything we see, but that we tend to see everything we believe. If we feel that we cannot become successful with our finances, everything we see tells us that can’t be. When we see others who are successful, it’s not because they are necessarily smarter or better than we are – it’s often due the application of their talent and their belief in the fact that they will be successful.

2) What do you expect?

As we gaze into life’s crystal ball, ponder the statement – “be careful what you wish for, you might just get it.” It’s no surprise that financially successful people tend to be those who had the expectation that they would be – then took the steps to educate themselves about the topic, surround themselves with like-minded people and are not afraid to ask for help in the areas where they lack expertise. Meanwhile, people who expect that life is going to be filled with negative experiences are usually not disappointed.

3) Do you Spend or Invest?

Our money (and our time…) can either be spent or invested. When we spend, we may get experiences (or goods) in exchange – but in either case we have less money or less time at the end of the transaction. When we invest our money or our time – we increase both the opportunity to learn and the opportunity to earn. Investing in ourselves (for example, reading the magazine you are holding…) increases our knowledge, exposes new opportunities and can fill the missing gaps in our education.

Step one – increase our education. Step two – ask good questions. Step three – make better decisions. I’m not 100% sure that during our time together I had changed anything about their way of thinking about money and their relationship with it. But when the conversation was over, we shook hands, and they said “So you really think it’s possible I can create a better financial future for myself?”. I said “Absolutely!” and of that I am 100% sure.