october, 2023

25octAll DayWindsor Family Credit UnionTBD

Event Details

Program: Stop Playing Chess in a PokerStars World If all you know is the outcome of a game of chess – you can

Event Details

Program: Stop Playing Chess in a PokerStars World

If all you know is the outcome of a game of chess – you can conclude with almost 100% accuracy that the best player won. There is no dice roll that suddenly removes your opponent’s bishop from the board. The outcome is determined by how skillfully each player moves their pieces. If you know who has the most chips at the end of a

game of Poker – what do you know? You know who has the most chips. You don’t know who the best player is, or the role that luck & emotion played. You can play poorly and win or be the best player and lose.

Chess is cerebral and played in one dimension against a single opponent. Poker is also cerebral but played in multiple dimensions and against multiple opponents where

a single turn of a card “the luck factor” plays a critical role. In Chess you can see your opponent’s pieces. In Poker – there is always hidden information. Is there any chance that the clients you have (and the prospects you hope to convert into clients) might be keeping some aspects of their personal financial lives hidden from view (and from you…)? If you think the answer is “My client would never do that!” – I have some potentially distressing news for you. They are.

Many of your clients think that personal finance is like chess – if they have the right strategy (and you as their trusted advisor) they will win. What happened to your client’s strategy in the early months of Covid-19 pandemic when global stock markets plummeted by 40% in March 2020? Suddenly, your client thinks their strategy is wrong and is tempted to change it (even worse, what if they think what happened is your fault?). We all know changes made during times of stress can lead to an even worse outcome. But wait, the global markets went up almost 50% over the next three months, and it’s been a roller-coaster ride since then. Nice.

In a global “post-pandemic” hyper-competitive financial marketplace, your clients and prospects have no shortage of advisors and companies trying to lure them away. I have a question for you: Will you lead or be left behind? Your clients (and prospects…) are looking for true financial leadership – solid time-tested advice and guidance to help them make the often-difficult financial decisions regarding insurance and investments as they seek to create a “Richly Imagined Future” for their families.

I will be sharing concrete real-world examples with the attendees of what their clients (and prospects) are struggling with in a post-pandemic environment and how financial professionals can (and must!) take a leadership role as their financial services provider. The key? Change from advising in one-dimension (chess) to a multi-dimensional style (poker).

My four-part process for accomplishing this will cover the following topics:

1) Dealing with a “Bad Beat” – A Bad Beat is a hand in poker that should be a winner – but loses. They bet a strong hand – the opponent makes a poor call that turns out in their favor. What about the 90-80-70 rule? Do you know how much it will affect your practice – I hope you do.

2) Playing the Next Hand – Just because you lose a hand you should have won, you don’t quit. Ask yourself the question – “What was the Goal?” and perhaps more importantly, how can we create “SMARTER” goals to better adapt to changing situations? But accomplishing goals is impacted by our “decision making” strategy, I’ll be taking attendees through a Decision / Outcome matrix as it relates to most every aspect of life. We forget that life is much more like poker than chess – good things or bad things can happen because of luck.

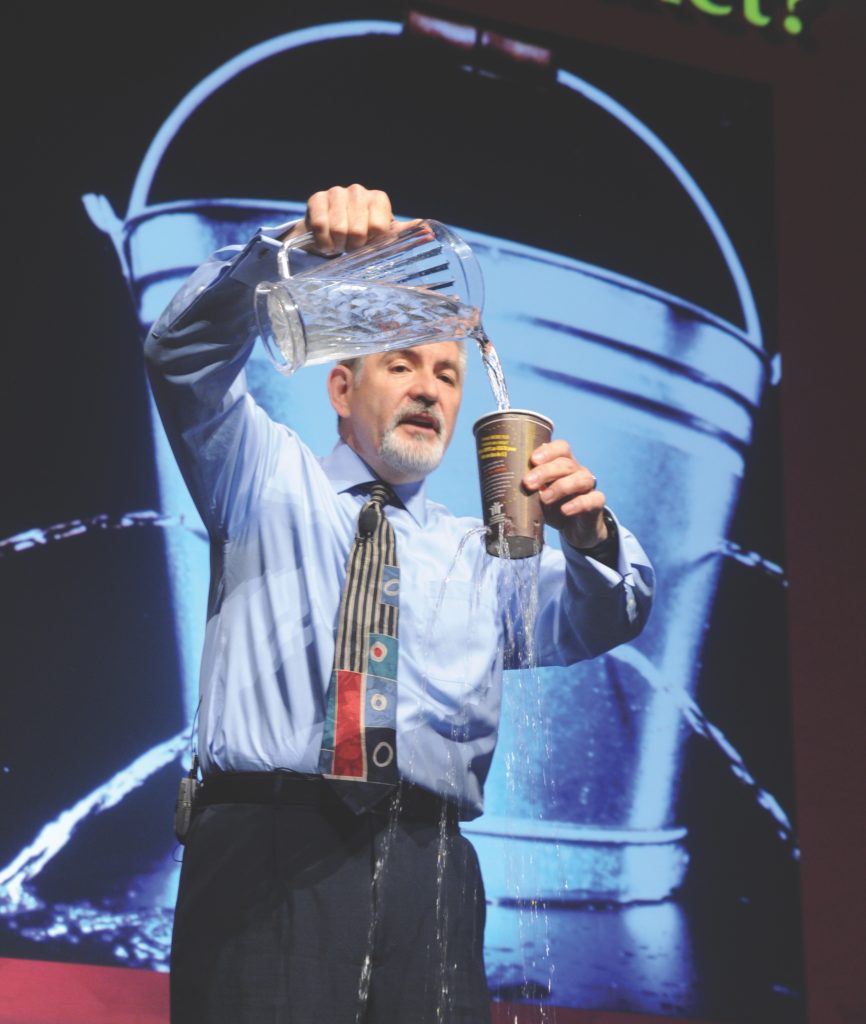

3) Rhythm Disrupting – How can you help your clients change trajectory toward their financial future? Help them plug holes in their financial bucket and keep them away from “financial fantasy” media. I will include my own personal experience with “The Diderot Effect” – in short, the more “shiny new stuff” they buy, the more they want, and you need to break your clients of this self-defeating habit.

4) Going “All In” – Helping your clients create the commitment to their financial success is not as difficult as you might think – everyone talks about “influencers” – it’s your time to become one. True professionals influence through conversation – because they are willing to have life’s “difficult discussions” with clients.

Do you want to supercharge your business results? Then take on the challenge to change your game, solidify your client’s outcomes (creating an army of referring fans), increase your conversion rate with your prospects and you’ll be on your way to creating the business you’ve been dreaming about.

Time

All Day (Wednesday) EST

Location

TBD

Organizer

Windsor Family Credit Union