june, 2020

15junAll DayIG Wealth Management (Ontario West)IG Wealth Management - Windsor

Event Details

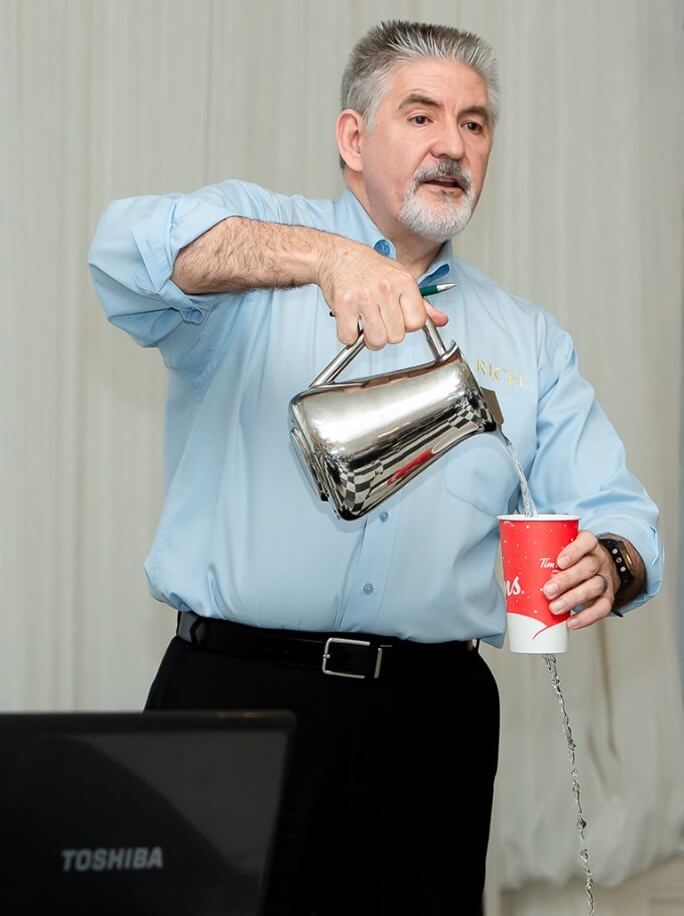

Robert Gignac will be speaking at a private consultant Webinar event on June 15th for IG Wealth Management (Ontario West). His topic

Event Details

Robert Gignac will be speaking at a private consultant Webinar event on June 15th for IG Wealth Management (Ontario West). His topic will be “Lead or be Left Behind”, a look at the role of the client/advisor relationship as seen by an actual client of the industry.

Presentation Synopsis – “Lead or Be Left Behind”

In the midst of the current COVID-19 crisis – your clients are looking for financial leadership Your clients are looking for financial leadership – solid advice and guidance in making the tough financial decisions they have to make for themselves, their families and in many cases, their businesses. Will you “Lead” or be “Left Behind”?

If COVID-19 was not enough on its own – toss Robo-Advisors, Brexit, President Trump and a millennial cohort who think financial advisors are “so last decade” into the mix. Finally, how do you deal with the impending estimated 700 Billion to 1.2 Trillion-dollar transfer of assets from one generation to the next – knowing that over 75% of those who inherit, “fire” the advisors who grew the assets.

Robert’s engaging presentation will offer concrete examples of what clients (and prospects…) are struggling with today and how Advocis members can take a leadership role as their financial services/product provider. Robert has over 20 years experience as a client of the Canadian financial services industry and via his Canadian bestseller “Rich is a State of Mind” he has spoken with clients just like yours from coast to coast. Their concerns might surprise you. They might scare you. They will certainly enlighten you.

The four key takeaways will be:

- Understanding your client’s “Current Reality” – What keeps us (your clients) awake at night? What stops us from committing the client/advisor relationship? How did CRM2 affect our reality? How will Robo-Advisors, demographics, global economics and future regulatory issues affect yours?

- Developing a client’s picture of their “Richly Imagined Future” – Your ability to help clients “picture” their future and discuss their goals will be the key to bringing the right mix of products and services to the table. Includes a discussion of SMART goals (and why they’re not always the answer to the problem).

- Developing an aptitude for “Disruption” – Some of your clients will not obtain the future they want – even with your help – unless certain financial behaviors change. At a professional level – your reluctance to embrace social media and Robo-Advisor technology will hamper your growth as financial professionals as well.

- Helping clients understand the power of “Choice” – Teaching us that “The choices you make determine the life you lead” and helping clients cut through the “clutter” of financial industry options may be one of the most important things you do for us. At the same time, understanding that “Was it all Worth It?” will be the most important question that your client ever asks – not of you – but of themselves.

Get ready to inspire and educate your clients – and perhaps most importantly – lead them – because if you aren’t willing to accept the leadership role, when you look behind you – there may not be any clients following.

Time

All Day (Monday) PST

Location

IG Wealth Management - Windsor

Organizer

IG Wealth Management