august 2025

Event Details

Robert has been short-listed to present his MDRT approved program "Stop Playing Chess in a PokerStars World" at the Advocis Atlantic School

Event Details

Robert has been short-listed to present his MDRT approved program “Stop Playing Chess in a PokerStars World” at the Advocis Atlantic School 2025. More details to follow….

Time

august 12 (Tuesday) - 14 (Thursday)

Location

Digby Pines Golf Resort and Spa

Event Details

Robert Gignac has made it to short-list for the Million Dollar Roundtable (MDRT) Global Meeting 2025 in Macau, China. His proposed topic

Event Details

Robert Gignac has made it to short-list for the Million Dollar Roundtable (MDRT) Global Meeting 2025 in Macau, China. His proposed topic is: “What Your Client Said (While You Weren’t Listening…)”

Looking forward to the Million Dollar Roundtable (MDRT) Global Meeting 2025 in Macau!

Time

august 24 (Sunday) - 27 (Wednesday)

Location

Macau, China

Organizer

MDRT (Million Dollar Round Table)

september 2025

Event Details

Robert is happy to be back speaking at the 23rd Annual Pro-Seminars’ National Advisor Conference 2025. His topic will be "What Your

Event Details

Robert is happy to be back speaking at the 23rd Annual Pro-Seminars’ National Advisor Conference 2025. His topic will be “What Your Client Said (While You Stopped Listening)”. A look at the “communication disconnect” of the Advisor/Client relationship. We’ll also talk about clients too, so don’t worry!

Time

15 (Monday) 12:00 am - 17 (Wednesday) 11:59 pm

Location

Tuscany Suites Resort & Casino

255 EAST FLAMINGO RD. LAS VEGAS, NEVADA 89169

Organizer

Pro-Seminarsalex@pro-seminars.com

october 2025

16octAll DayAdvocis Saskatchewan (** Date on Hold **)TBD

Event Details

Robert Gignac will be speaking at Advocis Saskatchewan on October 16th and he will be delivering his updated "Stop Playing Chess in

Event Details

Robert Gignac will be speaking at Advocis Saskatchewan on October 16th and he will be delivering his updated “Stop Playing Chess in a PokerStars World” program which debuted at MDRT 2022 in Sydney, Australia and updated for the Advocis Banff School in August 2023.

Presentation Synopsis – “Stop Playing Chess in a PokerStars World”

If all you know is the outcome of a game of Chess – you can conclude with almost 100% accuracy that the best player won. There is no roll of the dice that suddenly removes your opponent’s bishop from the board. The outcome is determined by how skillfully each player moves their pieces.

If you know who has the most chips at the end of a game of Poker – what do you know? You know who had the most chips. There is no way to know who the best player is, or the role that luck & emotion played. It’s possible to play poorly and win, or be the best player and lose.

In Chess you see your opponent’s pieces. In Poker – there is always hidden information. There is no chance any of your clients might be keeping some aspects of their personal financial life hidden from view (and from you…) is there?

Many of your clients think that personal finance is like Chess – if you have the right strategy, you will win. What happened to your client’s strategy during the 37% market drop in 22 days in March 2020? Suddenly, the client thinks the strategy is wrong and is tempted to change it. This can lead to an even worse outcome. But wait, then the market went up 42% over the next 52 days. Seriously?

Robert’s engaging presentation will offer concrete examples of what clients (and prospects…) are struggling with today and how financial professionals can take a leadership role as their financial services/product provider by changing from a one-dimensional game (chess) to a multi-dimensional one (poker). Robert has over 25 years experience as a client of the financial services industry and via his International bestseller “Rich is a State of Mind” he has spoken with clients just like yours, from coast to coast. Their concerns might surprise you. They might scare you. They will certainly enlighten you.

The four key takeaways will be:

Dealing with a “Bad Beat” – A Bad Beat is a hand in poker that should be a winner – but loses. They bet a strong hand – the opponent makes a poor call that turns out in their favour. Your clients likely had a full house – Covid-19 tossed 4 Jacks onto the table – and the media is saying they might never win again.

Playing the Next Hand – Just because you lose a hand you should have won, you don’t quit. Ask yourself the question – “What was the Goal?” and perhaps more importantly, how can we create “SMARTER” goals to better adapt to changing situations?

Rhythm Disrupting – How can you help your clients change trajectory toward their financial future. Help them become a 1%’er in terms of time management, help them plug holes in their bucket and keep them away from “financial fantasy” media.

Going “All In” – helping your client create the commitment to their financial success is not as difficult as you might think – everyone talks about “influencers” – it’s your time to become one.

It’s been said “To change your results, sometimes you have to change the game”. Take the challenge to change your game – and your clients outcomes – to build the business you desire.

Time

All Day (Thursday)

Location

TBD

Organizer

Advocis Saskatchewan

november 2025

11novAll DayMainstreet Credit Union (* Date On Hold For Client *)TBD

Event Details

Robert Gignac will be speaking at the Mainstreet Credit Union "All Hands" 2025 event on November 11th. His topic will be "Lead

Event Details

Robert Gignac will be speaking at the Mainstreet Credit Union “All Hands” 2025 event on November 11th. His topic will be “Lead or Be Left Behind”, a look at the role of the credit union professional within the member relationship. More details available here: Mainstreet Credit Union

Time

All Day (Tuesday)

Location

TBD

Organizer

Mainstreet Credit Union

22junAll Day25Million Dollar Roundtable (MDRT) Annual Meeting 2025Miami Beach, Florida

Event Details

Robert is looking forward to meeting his MDRT friends from across the globe in Miami in June 2025 and sharing some laughs

Event Details

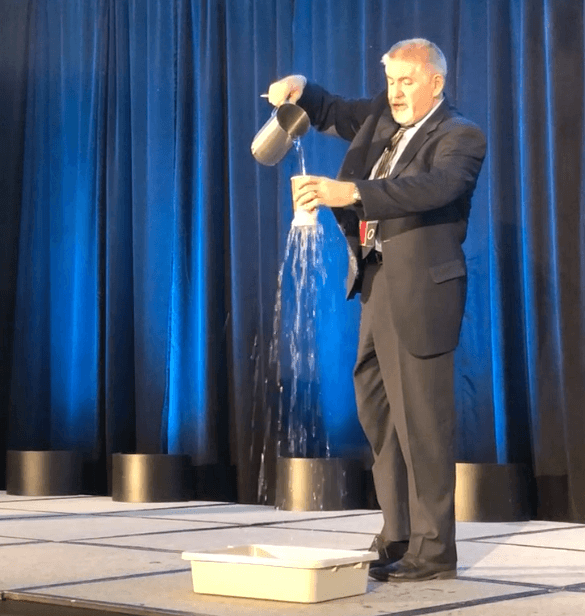

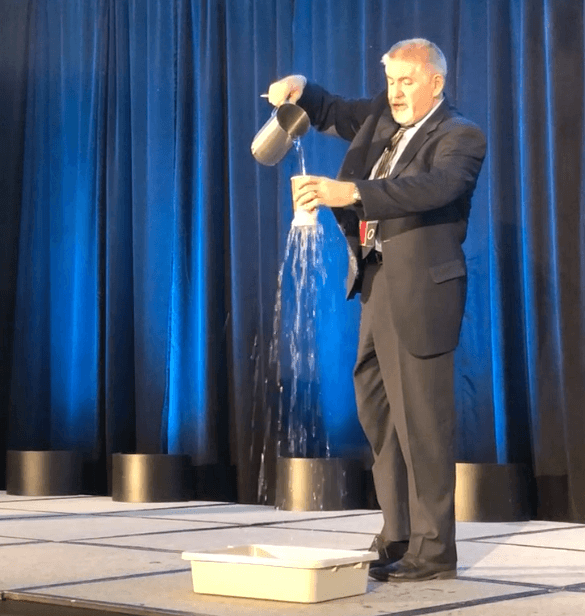

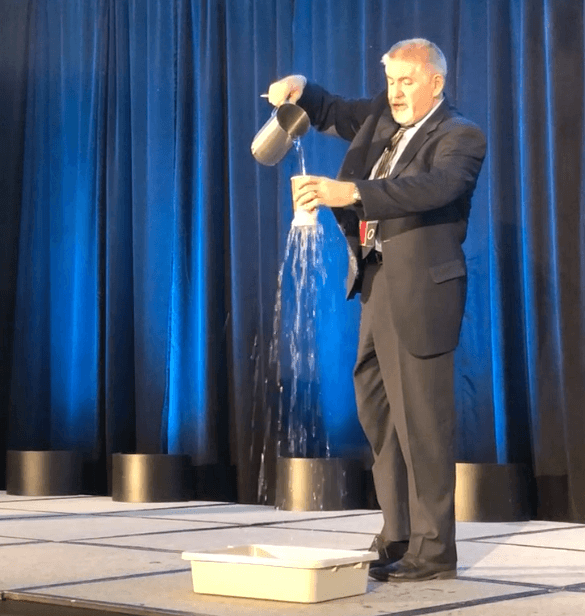

Robert is looking forward to meeting his MDRT friends from across the globe in Miami in June 2025 and sharing some laughs and attending some great learning sessions. He has his fingers crossed for an opportunity to speak at MDRT Global in Macau later this year (image above is from MDRT Global in Sydney in 2022…)

Here’s to 3 days of education and growth!

Time

june 22 (Sunday) - 25 (Wednesday)

Location

Miami Beach, Florida

Organizer

MDRT (Million Dollar Round Table)

25mayAll Day28Advocis Pacific School 2025Four Points by Sheraton Kelowna Airport

Event Details

Robert has been selected to present his MDRT approved program "Stop Playing Chess in a PokerStars World" at the Advocis Pacific School

Event Details

Robert has been selected to present his MDRT approved program “Stop Playing Chess in a PokerStars World” at the Advocis Pacific School 2025. More details to follow….

Time

may 25 (Sunday) - 28 (Wednesday)

Location

Four Points by Sheraton Kelowna Airport

28aprAll Day30FPA Retreat 2025 (** Date on Hold **)Chicago, IL

Event Details

Robert has been short-listed for the FPA Retreat 2025 in April. He would like to be presenting his "Stop Playing Chess in

Event Details

Robert has been short-listed for the FPA Retreat 2025 in April. He would like to be presenting his “Stop Playing Chess in a PokerStars World” or well as his highly regarded session “What Your Client Said (While You Weren’t Listening…)” More details to come.

Time

april 28 (Monday) - 30 (Wednesday)

Location

Chicago, IL

Organizer

FPA (Financial Planning Association)

24aprAll DayAdvocis Saskatchewan (** Date on Hold **)TBD

Event Details

Robert Gignac will be speaking at Advocis Saskatchewan on April 24th and he will be delivering his updated "Stop Playing Chess in

Event Details

Robert Gignac will be speaking at Advocis Saskatchewan on April 24th and he will be delivering his updated “Stop Playing Chess in a PokerStars World” program which debuted at MDRT 2022 in Sydney, Australia and updated for the Advocis Banff School in August 2023.

Presentation Synopsis – “Stop Playing Chess in a PokerStars World”

If all you know is the outcome of a game of Chess – you can conclude with almost 100% accuracy that the best player won. There is no roll of the dice that suddenly removes your opponent’s bishop from the board. The outcome is determined by how skillfully each player moves their pieces.

If you know who has the most chips at the end of a game of Poker – what do you know? You know who had the most chips. There is no way to know who the best player is, or the role that luck & emotion played. It’s possible to play poorly and win, or be the best player and lose.

In Chess you see your opponent’s pieces. In Poker – there is always hidden information. There is no chance any of your clients might be keeping some aspects of their personal financial life hidden from view (and from you…) is there?

Many of your clients think that personal finance is like Chess – if you have the right strategy, you will win. What happened to your client’s strategy during the 37% market drop in 22 days in March 2020? Suddenly, the client thinks the strategy is wrong and is tempted to change it. This can lead to an even worse outcome. But wait, then the market went up 42% over the next 52 days. Seriously?

Robert’s engaging presentation will offer concrete examples of what clients (and prospects…) are struggling with today and how financial professionals can take a leadership role as their financial services/product provider by changing from a one-dimensional game (chess) to a multi-dimensional one (poker). Robert has over 25 years experience as a client of the financial services industry and via his International bestseller “Rich is a State of Mind” he has spoken with clients just like yours, from coast to coast. Their concerns might surprise you. They might scare you. They will certainly enlighten you.

The four key takeaways will be:

Dealing with a “Bad Beat” – A Bad Beat is a hand in poker that should be a winner – but loses. They bet a strong hand – the opponent makes a poor call that turns out in their favour. Your clients likely had a full house – Covid-19 tossed 4 Jacks onto the table – and the media is saying they might never win again.

Playing the Next Hand – Just because you lose a hand you should have won, you don’t quit. Ask yourself the question – “What was the Goal?” and perhaps more importantly, how can we create “SMARTER” goals to better adapt to changing situations?

Rhythm Disrupting – How can you help your clients change trajectory toward their financial future. Help them become a 1%’er in terms of time management, help them plug holes in their bucket and keep them away from “financial fantasy” media.

Going “All In” – helping your client create the commitment to their financial success is not as difficult as you might think – everyone talks about “influencers” – it’s your time to become one.

It’s been said “To change your results, sometimes you have to change the game”. Take the challenge to change your game – and your clients outcomes – to build the business you desire.

Time

All Day (Thursday)

Location

TBD

Organizer

Advocis Saskatchewan

27marAll Day29Financial Hall of Fame Awards (** Date on Hold **)Victoria, BC

Event Details

Robert Gignac will be speaking at inaugural Financial Hall of Fame Awards on March 28th and he will be delivering his updated

Event Details

Robert Gignac will be speaking at inaugural Financial Hall of Fame Awards on March 28th and he will be delivering his updated “Stop Playing Chess in a PokerStars World” program which debuted at MDRT 2022 in Sydney, Australia and updated for the Advocis Banff School in August 2023.

Presentation Synopsis – “Stop Playing Chess in a PokerStars World”

If all you know is the outcome of a game of Chess – you can conclude with almost 100% accuracy that the best player won. There is no roll of the dice that suddenly removes your opponent’s bishop from the board. The outcome is determined by how skillfully each player moves their pieces.

If you know who has the most chips at the end of a game of Poker – what do you know? You know who had the most chips. There is no way to know who the best player is, or the role that luck & emotion played. It’s possible to play poorly and win, or be the best player and lose.

In Chess you see your opponent’s pieces. In Poker – there is always hidden information. There is no chance any of your clients might be keeping some aspects of their personal financial life hidden from view (and from you…) is there?

Many of your clients think that personal finance is like Chess – if you have the right strategy, you will win. What happened to your client’s strategy during the 37% market drop in 22 days in March 2020? Suddenly, the client thinks the strategy is wrong and is tempted to change it. This can lead to an even worse outcome. But wait, then the market went up 42% over the next 52 days. Seriously?

Robert’s engaging presentation will offer concrete examples of what clients (and prospects…) are struggling with today and how financial professionals can take a leadership role as their financial services/product provider by changing from a one-dimensional game (chess) to a multi-dimensional one (poker). Robert has over 25 years experience as a client of the financial services industry and via his International bestseller “Rich is a State of Mind” he has spoken with clients just like yours, from coast to coast. Their concerns might surprise you. They might scare you. They will certainly enlighten you.

The four key takeaways will be:

Dealing with a “Bad Beat” – A Bad Beat is a hand in poker that should be a winner – but loses. They bet a strong hand – the opponent makes a poor call that turns out in their favour. Your clients likely had a full house – Covid-19 tossed 4 Jacks onto the table – and the media is saying they might never win again.

Playing the Next Hand – Just because you lose a hand you should have won, you don’t quit. Ask yourself the question – “What was the Goal?” and perhaps more importantly, how can we create “SMARTER” goals to better adapt to changing situations?

Rhythm Disrupting – How can you help your clients change trajectory toward their financial future. Help them become a 1%’er in terms of time management, help them plug holes in their bucket and keep them away from “financial fantasy” media.

Going “All In” – helping your client create the commitment to their financial success is not as difficult as you might think – everyone talks about “influencers” – it’s your time to become one.

It’s been said “To change your results, sometimes you have to change the game”. Take the challenge to change your game – and your clients outcomes – to build the business you desire.

Time

march 27 (Thursday) - 29 (Saturday)

Location

Victoria, BC

Organizer

criticalinsurance.org

06marAll DayAdvocis KingstonCataraqui Golf and Country Club

Event Details

Robert Gignac will be speaking at Advocis Kingston on March 6th and he will be delivering his updated "Stop Playing Chess in

Event Details

Robert Gignac will be speaking at Advocis Kingston on March 6th and he will be delivering his updated “Stop Playing Chess in a PokerStars World” program which debuted at MDRT 2022 in Sydney, Australia and updated for the Advocis Banff School in August 2023.

Presentation Synopsis – “Stop Playing Chess in a PokerStars World”

If all you know is the outcome of a game of Chess – you can conclude with almost 100% accuracy that the best player won. There is no roll of the dice that suddenly removes your opponent’s bishop from the board. The outcome is determined by how skillfully each player moves their pieces.

If you know who has the most chips at the end of a game of Poker – what do you know? You know who had the most chips. There is no way to know who the best player is, or the role that luck & emotion played. It’s possible to play poorly and win, or be the best player and lose.

In Chess you see your opponent’s pieces. In Poker – there is always hidden information. There is no chance any of your clients might be keeping some aspects of their personal financial life hidden from view (and from you…) is there?

Many of your clients think that personal finance is like Chess – if you have the right strategy, you will win. What happened to your client’s strategy during the 37% market drop in 22 days in March 2020? Suddenly, the client thinks the strategy is wrong and is tempted to change it. This can lead to an even worse outcome. But wait, then the market went up 42% over the next 52 days. Seriously?

Robert’s engaging presentation will offer concrete examples of what clients (and prospects…) are struggling with today and how financial professionals can take a leadership role as their financial services/product provider by changing from a one-dimensional game (chess) to a multi-dimensional one (poker). Robert has over 25 years experience as a client of the financial services industry and via his International bestseller “Rich is a State of Mind” he has spoken with clients just like yours, from coast to coast. Their concerns might surprise you. They might scare you. They will certainly enlighten you.

The four key takeaways will be:

Dealing with a “Bad Beat” – A Bad Beat is a hand in poker that should be a winner – but loses. They bet a strong hand – the opponent makes a poor call that turns out in their favour. Your clients likely had a full house – Covid-19 tossed 4 Jacks onto the table – and the media is saying they might never win again.

Playing the Next Hand – Just because you lose a hand you should have won, you don’t quit. Ask yourself the question – “What was the Goal?” and perhaps more importantly, how can we create “SMARTER” goals to better adapt to changing situations?

Rhythm Disrupting – How can you help your clients change trajectory toward their financial future. Help them become a 1%’er in terms of time management, help them plug holes in their bucket and keep them away from “financial fantasy” media.

Going “All In” – helping your client create the commitment to their financial success is not as difficult as you might think – everyone talks about “influencers” – it’s your time to become one.

It’s been said “To change your results, sometimes you have to change the game”. Take the challenge to change your game – and your clients outcomes – to build the business you desire.

Time

All Day (Thursday)

Location

Cataraqui Golf and Country Club

Organizer

Advocis Kingston